Monthly Commentary | April 1, 2025

April Commentary 2025

A review of our portfolio results starting from 11/4/2024, the day before the presidential election, to 3/27/2025 indicates an average return of -.03%. In our view, results in your portfolio reflect political uncertainty, not changes in the U.S. economy. Initially, markets reacted favorably to Donald Trump’s election, increasing through Mid-February to a 10% gain, only to give it all away resulting from uncertainty created by DOGE politics and threats of tariffs.

Uncertainty has affected most forecasters, including our own forecasts. Throughout the remainder of 2025, we believe that the fundamental strength of the economy will override the current volatility and contribute to future gains in financial markets, including stocks. The Federal Reserve Bank (FRB) has recently revised its forecast for Gross Domestic Product (GDP) growth to below 2%, still indicating solid economic growth. In the FRB’s view, inflation remains anchored at lower levels, with two interest rate cuts hinted at in 2025. The labor force experienced a more modest level of growth but continuing to expand, and productivity is growing at 2%.

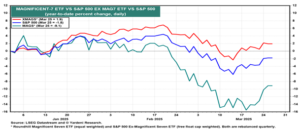

We have written about the Magnificent 7 in three of our last monthly discussions because they have contributed so much to investment returns during the past two years and offer the appearance of a building bubble, which can lead investors to precipitous declines in stock prices. In each discussion, we try to assess the immediate risk associated with the level of forward PE for the group. The recent sell off has left the group trading at mid-twenties in forward price to earnings ratios. Typically, not a level that results in unexpected declines. The chart above tracks in green the Magnificent 7. The blue line represents the S&P 500 while the red is the S&P 500 less the Magnificent 7. During the sell off, the Magnificent 7 lost 20%, while the 493 lost a modest 10%.

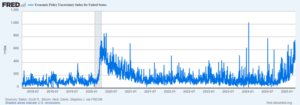

A further sign of uncertainty in current markets is the Federal Reserve Bank’s Uncertainty Index illustrated in the chart. Wide swings in the market are indicative of periods of uncertainty. Friday’s 700-point decline followed by Monday’s 400-point gains simply highlights the uncertainty investors perceive in the market this week.

At Worcester Advisors, we continue to recommend investment in well diversified portfolios of high-quality companies with consistent earnings growth as the safest method of achieving capital growth.

Your Team,

Dave, Joe, Sangam, Jake, Anton, & Sandhya

Request Your Complimentary Consultation

KEEP READING