Monthly Commentary | August 1, 2024

August 2024 Commentary

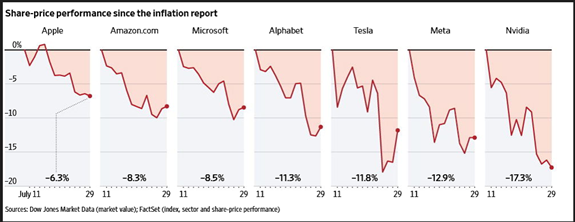

The decline of the NASDAQ index on July 23 was 3.6% attributed to earnings misses by Tesla and Alphabet, but precipitated declines in many technology favorites. The Magnificent Seven fared unevenly during the 19 days ending 7/29/24. The following from the July 30 Wall Street Journal highlights the potential for volatility.

Artificial Intelligence (AI) is ramping expectations of higher earnings gains among technology stocks, particularly among current market favorites, the magnificent seven, some of the groups are among the leaders in AI. There are only outsized estimates for additional earnings to be generated by AI in spite of Microsoft’s modest miss this week.

Of course, we don’t know if or when a decline in technology stocks will prove lasting. Remembering the 1990’s, we have cautioned about rising levels of allocation to risk assets in your portfolios, trimming names whose gains appear so lasting. We do know that prudent investment requires that we adhere to our measures of risk, valuation, and portfolio allocations.

While we continue to forecast continued gain in stocks, we have been reducing exposure to risk assets during the past few months due to gains in stock market values during the past twenty months. We do not forecast a correction, but realize one could occur prompted by a political or unforeseen economic event causing as much as a 20% reduction in the value of your holdings. Predicting such an event is problematic.

Your team,

Dave, Joe, Sangam, Anton, & Jake

Request Your Complimentary Consultation

KEEP READING