Monthly Commentary | August 1, 2025

August 2025 Commentary

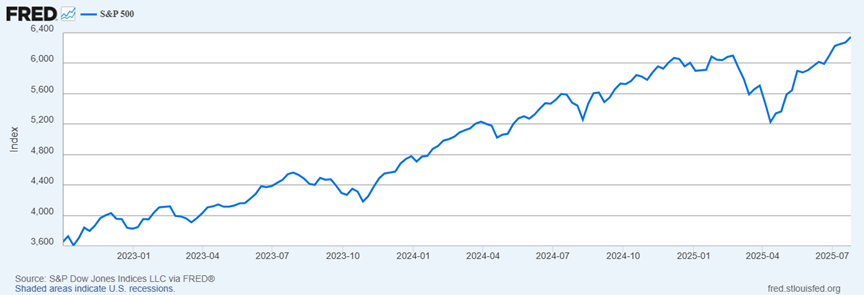

On July 28th, Ed Yardeni was featured on CNBC where he described the U.S. economy as “amazingly resilient.” Over the last three and a half years, when faced with a global pandemic, supply-chain disruptions, inflation, and fed tightening, the economy defied widespread recession forecasts and continued to grow, as displayed in the graph below.

After the president postponed the implementation of Tariffs, markets quickly stabilized. Since the bottom of the market on April 8th, the S&P 500 has gained 25%, bringing the S&P 500 and the Nasdaq to record levels, demonstrating a near perfect V-shaped recovery. This has been a difficult period for forecasters, ourselves included. However, with the recent momentum in the market, Fidelity now forecasts continued earnings growth for the remainder of 2025 and double-digit growth of earnings in 2026. Additionally, they noted that a single quarter runup in the stock market of 25% has only occurred six times in history. In each of those instances, the stock market posted gains in the following 12 months, averaging 14%.

Zacks Investment Research recently affirmed their position that the risk of recession is low, and that “all six of the major economic gauges remain expansionary.” They point to growing retail sales, low unemployment, increased industrial production, and expanding corporate earnings as indications of a strong economy. Tracking the movement of stocks, technology is again in the lead, particularly those associated with Artificial Intelligence. In their recent publication of earnings trends, Zacks forecasts that 10 of 16 sectors will produce positive earnings growth in 2025, with double-digit growth in Aerospace, Consumer Discretionary, Medical, and Technology. Supporting this outlook, Yardeni cites rising productivity in the technology industry as a contributing factor to earnings growth momentum.

At Worcester Advisors, we continue to recommend investment in well diversified portfolios of high-quality companies with consistent earnings growth as the safest method of achieving capital growth.

Your team,

Dave, Joe, Sangam, Jake, Anton, & Sandhya

Request Your Complimentary Consultation

KEEP READING