Monthly Commentary | May 1, 2024

May 2024 Commentary

Two weeks ago, reacting to a month over month spike in inflation measures Jerome Powell, citing higher than anticipated inflation trends, announced that the Federal Reserve Bank was unlikely to lower interest rates three times during 2024. Investors can buy bonds or stocks depending on their outlook for economic trends. If rates then will remain higher during 2024, owning stocks could be less attractive than owning bonds, consequently shown by the decline of share prices of large cap stocks by about 4% after his announcement. Some relief occurred this week as large technology companies saw some recovery but fell short of previous highs. Meta’s earnings miss has technology stocks weakening the very next day.

Investments whether stocks, bonds, options or commodities often trade at expectations of value to be achieved in twelve months. The day-to-day price fluctuation of stocks and indices, can cause many a sleepless night for unwary investors. Longer term trends in stock and indices prices are driven by forward trends in earnings. As we wrote last month, S&P500 earnings are forecast to grow by 11% in 2024 and 13% for 2025. If accomplished we can anticipate gains in stocks through 2025 at minimum.

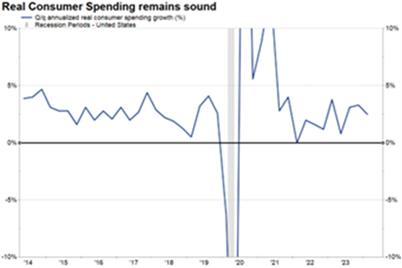

While the FRB was hiking interest rates during 2022-2023, most forecasters predicted a slowing economy as higher interest rates took their toll on economic growth. Jeremy Siegal Professor Emeritus of the Wharton School, like us, consistently forecasted continued economic expansion, which provided an opportunity for stock market gains. We continue to forecast positive results in stocks for the remainder of 2024 as does Professor Seigal. Consumer spending, remained quite solid in the period (as shown in the chart). The segment grew at a rate of +2.5% in the period. Consumer spending accounts for approximately 70% of total economy.

Your team,

Dave, Joe, & Sangam

Request Your Complimentary Consultation

KEEP READING