Monthly Commentary | June 1, 2024

June 2024 Commentary

The S&P 500 had an impressive performance in May 2024, rising 4.8% for the month. This marked the index’s strongest May since 2009, when it gained 5.3% as stocks were rallying off the financial crisis lows. Year-to-date through the end of May, the S&P 500 was up 11.21%, one of its best starts to a year in the past 25 years.

Specifically, the S&P 500 Total Return index closed at 11,494.70 on May 31, 2024, up 0.81% on the day. This capped off a remarkable run for the first five months of 2024, with the index benefiting from factors like growth in artificial intelligence and positive economic forecasts.

Historically, May is typically a weaker month for stocks, with the S&P 500 averaging a 0.1% decline in the month since 1950. However, 2024 bucked that trend in a major way. The 11.21% year-to-date gain through May ranks as just the 3rd time in 25 years the index was up over 10% by that point, after 2013 (+14.34%) and 2021 (+11.93%).

The strong May performance increases the odds of a continued summer rally, especially in a presidential election year when the market tends to perform well from April through October. However, a close election race with an uncertain outcome could dampen any rally.1

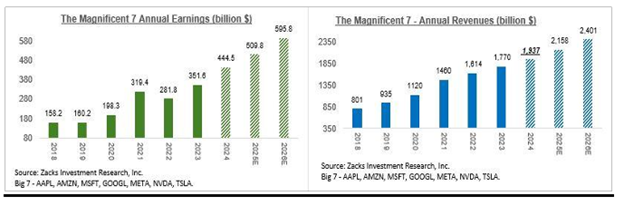

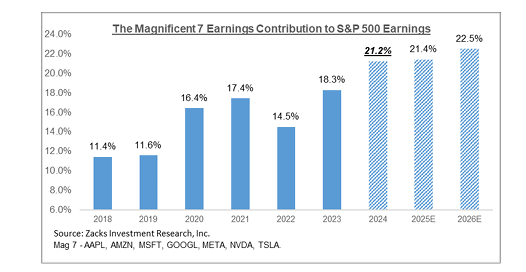

Zacks chart demonstrating Magnificent 7 growth of Earnings and Revenues since 2018 details growth well in excess of S&P500 average explaining why the price performance of the group is so much greater than market averages.

Zacks chart demonstrating Magnificent 7 growth of Earnings and Revenues since 2018 details growth well in excess of S&P500 average explaining why the price performance of the group is so much greater than market averages.

The extraordinary growth of the Mag 7 and many Technology companies offers both an opportunity for investors and risks similar to those that occurred in the early years of this century when stock market averages tumbled 50%.

Forecasts for earnings growth of S&P500 companies remains strong into 2026 providing tailwinds for further gain from carefully managed equity portfolios.

Regards,

Dave, Joe, Sangam, & Anton

- With AI in the news daily we have ventured into the mix by using Perplexity AI to draft the first four paragraphs of our discussion today. The Wall Street Journal rated the leading Chatbots. Perplexity was ranked among the best.

Request Your Complimentary Consultation

KEEP READING