Monthly Commentary | October 1, 2025

October 2025 Commentary

Year-to-date, the S&P 500 has gained 13.44. The winners so-far this year have been communication services, materials, information technology, financials, and utilities, all gaining over 15%. Healthcare is the only sector with negative performance this year, primarily due to political pressure pushing pharmaceutical and healthcare companies to lower prices. However, the sector currently trades at 13X forward earnings, a significant discount from the S&P 500, which we view as a potential buying opportunity for some stocks well positioned for growth.

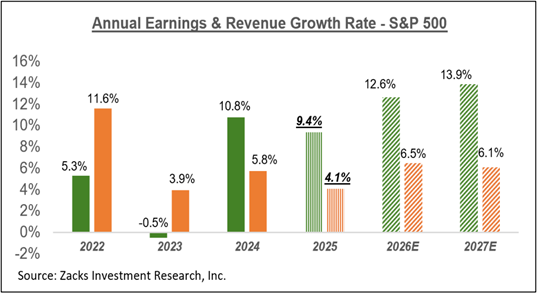

Continuing its dominance, the Magnificent 7 is again in the lead, returning nearly 20% this year. The group accounts for 25% of the total S&P 500 earnings and 34.4% of its entire market capitalization, which is mainly driven by the group consistently growing earnings at a faster rate than the rest of the market. Current estimates from Zacks forecast total S&P 500 earnings to grow 9.4% in 2025 compared to the Mag 7’s growth of 17.6%.

However, looking forward, the spread between the two groups’ earnings is projected to narrow. In 2026 and 2027, total S&P 500 earnings are projected to grow 12.6% and 13.9%, slightly below the target for the Mag 7 of 14.6% and 15.9%. With lower pricing multiples and improving earnings projections, forecasters such as Ed Yardeni predict that we will see the current bull market broaden to boost the relative performance of the other 493 companies.

Second quarter GDP growth has been upwardly revised twice and is now 3.8%, its strongest level in two years. At the beginning of this year, we wrote extensively about productivity growth and how large-scale investments into technology will deliver higher profits for corporations. That prediction has held up well this year. The September 25th publication of the Wall Street Journal specifically pointed to business investment in software and equipment powering AI as a driver of second quarter GDP growth. Software spending on intellectual property and research and development rose at an annual rate of 15%, its highest level since 1999, a sign of future productivity improvements.

Despite recent weakening in the labor market, unemployment remains low, and inflation, for the most part, has shrugged off pressure from tariffs. Professor Emeritus Jeremy Siegel from Wharton School of Business recently published that price pressure reflects political uncertainty rather than weakening in the US economy. In fact, retail spending remains strong, with July and August seeing solid increases, a sign of resilience in the US economy. The PCE deflator, a measure of inflation, matched all expectations in September, continuing its trend of disinflation and keeping the door open for another rate cut.

At Worcester Advisors, we continue to recommend investment in well diversified portfolios of high-quality companies with consistent earnings growth as the safest method of achieving capital growth.

Your team,

Dave, Joe, Sangam, Jake, & Anton

Request Your Complimentary Consultation

KEEP READING