Monthly Commentary | December 1, 2025

December 2025 Commentary

The month of November was tepid, at best, for stocks. Spontaneous fears of overvaluation in the technology industry and fears of lowering demand in AI caused significant intraday volatility on multiple occasions throughout the month. However, those fears have been somewhat sidelined after strong corporate earnings from AI-related companies, and renewed optimism about a December rate cut. Viewing the November volatility as a healthy correction, the S&P has nearly regained any loss from the beginning of the month, posting a year-to-date return of 15.5%.

The Magnificent 7 this year has accounted for 25% of earnings for the entire S&P 500. Including other mega-cap tech companies not featured in the exclusive “Mag 7,” that number would move towards 30-40%. In a market driven by capital expenditures from large tech companies, plenty of skeptics point to high valuations as evidence of a dot-com-like bubble. However, there are some central aspects of today’s market that significantly differs from the scenario in 2000. Denise Chisholm, director of quantitative market strategy for Fidelity provides an excellent analysis: “In 1998–2000, companies were spending 3.5–4x their free cash flow on capex — classic boom-era behavior. Today, that ratio is below 1 — even lower than during the energy capex surge of 2006–2007.” This means that, companies in today’s market are only spending what they earn, a strong signal that indicates a position of strength and supports growth. Looking at valuations and price multiples, the median tech stock in 2000 traded for 70x earnings, 233% higher than the median multiple of 30x that we see among tech companies in today’s market. Compared to historical averages, yes, valuations are elevated, but they are supported by strong earnings and healthy margins.

Data provided by Zacks Investment Research supports a positive outlook for the U.S. stock market and overall earnings trends. In September, we digested data from Q2 and found that 80.3% of S&P 500 companies reported a positive earnings surprise, with total earnings up 11.2% from the prior year. This month, we are digesting Q3 earnings. Of the 466 companies that have reported Q3 results, the number of companies that reported a positive earnings surprise increased to 83%. Total earnings growth also improved to 14% from the same quarter last year. Additionally, margins have been expanding. Among the group, the average net margin is 13.93%. This figure is higher than last quarter, the quarter before that, as well as the 20-quarter average of 11.95%. In plain terms, companies have been making more money and making it more efficiently.

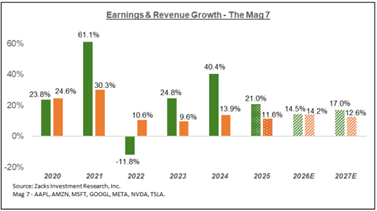

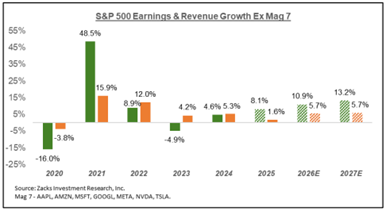

Looking at growth estimates between the Mag 7 and the remainder of the S&P 500, we are collecting more evidence of the “broadening out” of returns that we have extensively written about this year. As pictured in the graphs below, earnings projections from Zacks depict a narrowing of the spread between Mag 7 earnings growth and earnings growth of the remainder. In 2024, the difference was 35.8%, which is projected to fall to 12.9% in 2025 and then 3.6% the following year.

There have been also some notable developments regarding the status of a December rate cut and in the future composition of the Federal Reserve. Specifically, recent data indicating a further softening of the labor market has spiked the possibility of a December cut, and Kevin Hasset, current director of the National Economic Council of the United States, has emerged as President Trump’s frontrunner in the race for the Fed Chair. If Hasset takes on the role, it is likely that he will implement more aggressive rate cuts and looser monetary policy.

At Worcester Advisors, we continue to recommend investment in well diversified portfolios of high-quality companies with consistent earnings growth as the safest method of achieving capital growth.

Your team,

Dave, Joe, Sangam, Jake & Anton

Request Your Complimentary Consultation

KEEP READING