Monthly Commentary | February 1, 2024

February 2024 Commentary

Good morning,

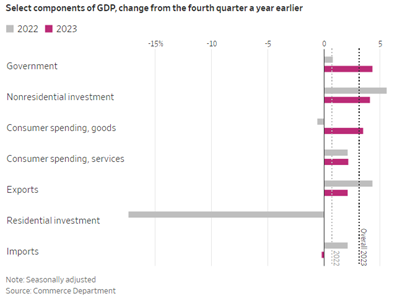

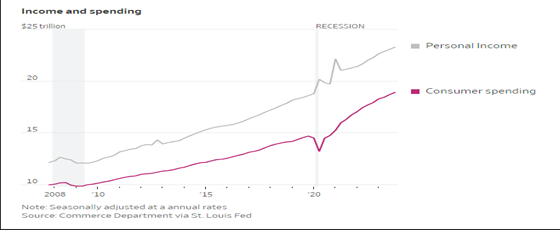

According to the Commerce Department, the economy grew 3.3% during the fourth quarter of 2023, with consumer spending, driven by payroll increases, contributing 1.9%. The full year 2023 GDP locked in at 3.1%, a robust growth level considering that many economists were forecasting recession. As forecasted by Treasury Secretary Yellen and the Federal Reserve Board, wages, employment, and spending have contributed to this soft landing. Higher wages will continue to encourage spending into 2024, raising the prospects for sustained economic growth and strong performance by profitable stocks.

In 2023, gains in the S&P500 and NASDAQ were concentrated in a few stocks, labeled as the “MAGNIFICENT SEVEN” (Apple, Alphabet, Amazon, Meta, Netflix, Nvidia and Tesla), most in the forefront of AI. While we invest in most of these companies, we do not overweight them, as many mutual funds do. Remember, between 1995 and its peak in March 2000, investments in the NASDAQ composite stock market index rose 800%, only to fall 78% from its peak by October 2002, giving up all its gains during the bubble. Although the current dominant stocks are not as overvalued as those stocks of the “dot com bubble,” having the portfolio dominated by only a few names creates a high level of risk, which is why we focus on diversification across sectors and classes. We believe this will benefit long term investors, particularly now, as we are beginning to see a small broadening within the market, as evidenced by Berkshire Hathaway, Visa, McDonald’s and Marriott International all hitting new highs in early 2024. Although the list of stocks with marked 2024 gains is still short, we expect additional companies to follow suit as the Bull Market expansion continues.

This week, the Federal Reserve Board will review the latest inflation data and continue to chart the course for interest rates throughout the year. If they hold rates steady, spring will be right around the corner, but if they cut rates, we’ll have six more weeks of winter.

Happy Groundhog’s Day!

Dave, Krista, Joe, & Sangam

Request Your Complimentary Consultation

KEEP READING