Monthly Commentary | January 1, 2025

January 2025 Commentary

Happy New Year!

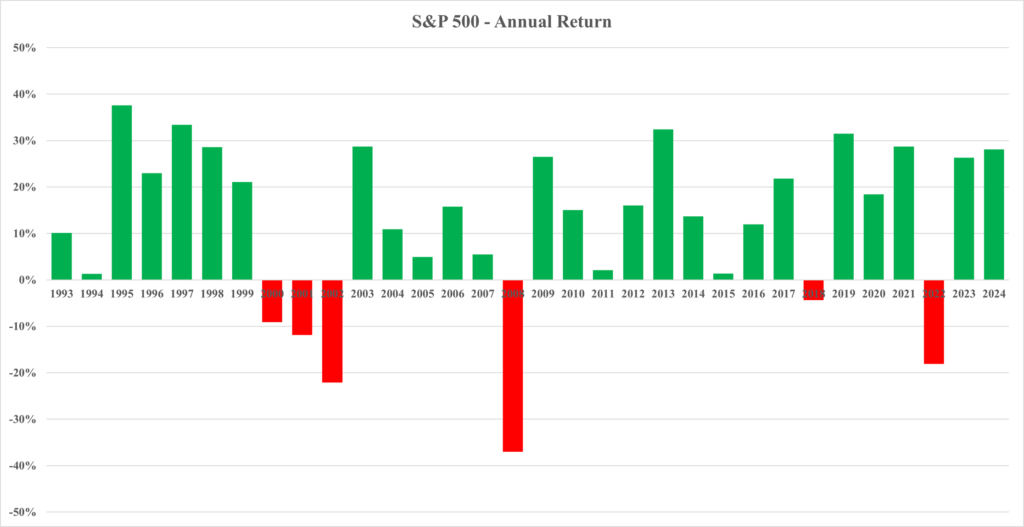

Investment results for the past two years have been quite rewarding to investors, with the S&P 500 yielding double digit returns for two years in a row. Sustained growth at this level for consecutive years rivals returns last seen in the 1990’s, prompting many to ask: Will stocks continue to provide strong returns in 2025?

In our view, forecasting begins with the data available for next year. Zacks Investment Research currently forecasts earnings growth of 13.9% and revenue growth of 5.5% for the S&P 500, which is widely regarded as the best single gauge of large cap U.S. equities. As higher earnings normally translate to higher stock prices during the period, this outlook favors 2025 as a strong year for stocks.

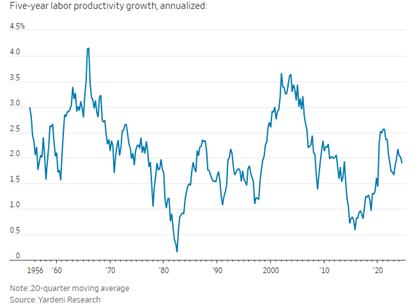

The Wall Street Journal wrote last week that the U.S. could be on the cusp of a productivity boom reminiscent of the second half of the 1990’s which was triggered by technology. The Congressional Budget Office (CBO) sees federal debt held by the public rising from 99% of gross domestic product in 2024 to 116% in 2034. This assumes total factor productivity growth of just 1.1% per year. Raising this estimated productivity growth by just half of a percentage point would mean the debt-to-GDP ratio reaches a much more manageable level of 108% by 2034. Ed Yardeni’s forecast on productivity growth would indicate an overall bullish outlook for the stock market in 2025. He forecasts a boost in productivity that could reach 3.5% in the second half of this decade, a boom in profitability for constituents of the S&P 500.

The Wall Street Journal wrote last week that the U.S. could be on the cusp of a productivity boom reminiscent of the second half of the 1990’s which was triggered by technology. The Congressional Budget Office (CBO) sees federal debt held by the public rising from 99% of gross domestic product in 2024 to 116% in 2034. This assumes total factor productivity growth of just 1.1% per year. Raising this estimated productivity growth by just half of a percentage point would mean the debt-to-GDP ratio reaches a much more manageable level of 108% by 2034. Ed Yardeni’s forecast on productivity growth would indicate an overall bullish outlook for the stock market in 2025. He forecasts a boost in productivity that could reach 3.5% in the second half of this decade, a boom in profitability for constituents of the S&P 500.

Alternatively, Jeremy Siegel’s forecast for 2025 projects that gains will be capped at 10%, with large-cap tech stocks seeing flat returns. After two “blockbuster years,” he forecasts that the S&P 500 will be running on fumes and, although he forecasts a laggard year for the Mag-7, he predicts that undervalued small- and mid-cap stocks will rally. The frenzy for artificial intelligence has sent some large-cap tech companies soaring, and he advises investors to remain attentive as valuations continue to rise. In such an environment, diversified portfolios, comprised of stocks that are trading within historic ranges and show good earnings growth trends, should be well positioned for gains.

Your Team,

Dave, Joe, Sangam, Jake, Anton & Sandhya

Request Your Complimentary Consultation

KEEP READING