Monthly Commentary | July 1, 2025

July 2025 Commentary

In recent months, the market has shown impressive strength. According to the Wall Street Journal, as of June 30th, the S&P 500 has gained 5% year-to-date, an impressive rebound after it had plummeted nearly 20% from its previous high in February to its low on April 8th. The drop was can be attributed to fears that tariffs, potentially as high as 145% on China and 50% on other major trading partners, would cause a jump in inflation and a hike in interest rates. Trump has since significantly dialed back the extent of tariffs from what was first proposed and, although they did come into effect in February, their impact on inflation has been milder than feared. At the same time, excitement around Artificial Intelligence and technology has fueled major gains. Tech stocks particularly suffered during the tariff selloff, but have since boomeranged, rallying 40% since their April lows, outperforming the S&P 500’s recovery of 23%.

Regarding the macroeconomy, for the first time in three years, the U.S. economy officially shrunk, which was not reflected in the stock market whatsoever. Original reports estimated a contraction of 0.3%, but that number has been further revised down to 0.2% as more data is reported. This slight contraction is mainly due to two causes: a surge in imports and a dip in consumer spending. To get ahead of potential future tariffs, many U.S. companies ramped up their volume of imports in the first three months of 2025, bringing the trade deficit to record highs. As trade deficits are directly subtracted from GDP, a slight GDP contraction would be expected with a surge of imports to this scale. With both the S&P 500 and the Nasdaq reaching all-time highs at the end of last week, it appears that the market had, at least somewhat, expected this outcome. On the consumer spending front, total spending declined by 0.1% in the month of May, weaker than forecasts.

At Worcester Advisors, we place a lot of importance on earnings (EPS) growth projections in analyzing potential investments. EPS growth is widely regarded as a reliable proxy for stock price growth. Positive revisions of EPS growth are viewed favorably in the market while negative revisions are typically associated with falling stock prices. From the peak of the market on February 19th to the bottom on April 8th, analysts across the country lowered their EPS growth projections for the S&P 500 as a response to tariff threats. Accordingly, the S&P 500 dipped nearly 20%. However, since President Trump’s announcement of delays on April 9th, the S&P 500 has rallied by 23%, and analysts across the board have since upwardly revised their projections for EPS growth and their targets for the S&P 500.

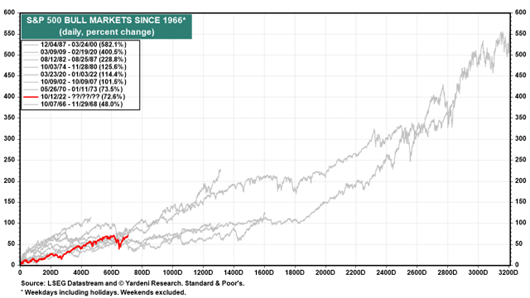

Ed Yardeni from Yardeni Research recently published, “So far, the current bull market looks like a normal one, with the potential to match returns of some of the best bull markets since the mid-1960s,” as represented in the chart below.

Yardeni places a target of 6500 on the S&P 500, implying more upside this year from its current level of ~6200. In their recent publication of earnings trends, Zacks Investment Research forecasts that 10 of 16 sectors will produce positive earnings growth in 2025, with double-digit growth in Aerospace, Consumer Discretionary, Medical, and Technology. As was seen in the previous 2 years, the Mag 7 again leads the pack, with EPS expected to grow 12.0% on 8.3% higher revenues. EPS of the other 493 companies in the S&P 500 are expected to rise 5.5%, an improvement from the 4% growth experienced in 2024.

At Worcester Advisors, we continue to recommend investment in well diversified portfolios of high-quality companies with consistent earnings growth as the safest method of achieving capital growth.

Your team,

Dave, Joe, Sangam, Jake, Anton, & Sandhya

Request Your Complimentary Consultation

KEEP READING