Monthly Commentary | May 1, 2025

May 2025 Commentary

Dow Headed for Worst April Since 1932 as Investors Send ‘No Confidence’ Signal

The April 21st publication of the Wall Street Journal blared the above caption after the President imposed tariffs on much of the world on February 19, rattling financial markets worldwide. The President’s tariff process has included major policy reversals, which has created confusion among investors and is best portrayed by changes to forecasters’ earnings projections expressed by the chart below.

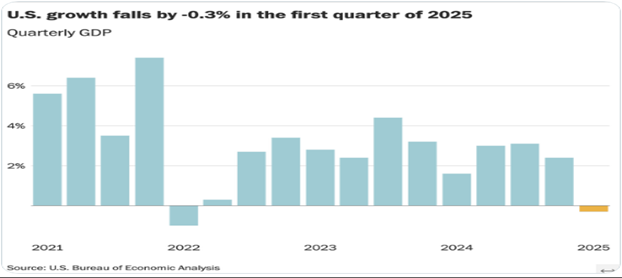

GDP released today has the second quarter of decline in the past five years. Heavy first quarter purchases by wholesalers and retailers in efforts to front run tariff price increases negatively skewed GDP.

The sudden decline in stock prices after the President’s tariff announcement was soon followed by a 50% recoup fueled by the announcement of a 90-day postponement of tariff implementation. Investor optimism could be ascribed to the expectation that the cooling off period creates the opportunity to initiate meaningful negotiations to resolve trade disparities and a refocus on domestic economic growth. In that case, the predicted declines in profitability in the first chart above may reverse, offering the potential for growth during the second half of 2025.

At Worcester Advisors, we continue to recommend investment in well diversified portfolios of high-quality companies with consistent earnings growth as the safest method of achieving capital growth.

Your Team,

Dave, Joe, Sangam, Jake, Anton, & Sandhya

Request Your Complimentary Consultation

KEEP READING