Monthly Commentary | November 1, 2025

November 2025 Commentary

Tariff uncertainty continues to be one of the main center points of the stock market. Investors are particularly focused on staying up-to-date with the President’s actions regarding foreign trade policy, and new trade deals/complications seemingly arise every other day. However, despite the uncertainty, the stock market and U.S. economy have remained resilient. On Liberation Day, when the President announced sweeping reciprocal tariffs, the stock market experienced a fast selloff, reaching its bottom just a week later, on April 8th. Since then, the S&P 500 has gained 35%, fully recouping any losses and now posting a 15% gain year to date.

Similarly, tariff announcements immediately heightened concerns around inflation and GDP. Businesses responded to these worries by front-loading their imports in Q1, hoping to import as much product as possible before the implementation of the reciprocal tariffs. As imports are directly subtracted from GDP, the U.S. economy slightly contracted in the first quarter of 2025. In the following quarter, trade tensions had eased, and GDP subsequently grew by 3.8%, the fastest pace in nearly two years. Inflation is particularly important in the current interest rate environment. At the beginning of this year, investors anticipated a handful of cuts in 2025. However, the labor market remained strong and economists worried that tariffs would cause a spike in inflation. This, in turn, discouraged the Fed from cutting rates, and we saw that rates remain unchanged in four consecutive meetings. Then, after a concerning jobs report in August, the Fed lowered rates in September. Leading up to the Fed’s meeting in October, the market widely anticipated a rate cut, and with inflation coming in lower than expected, the door was opened for an October cut.

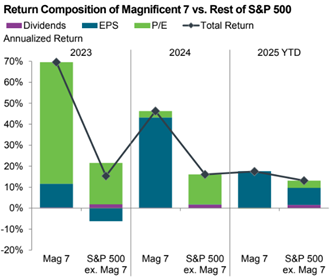

According to Fidelity, earnings growth has become the leading metric for evaluating stock price growth, and today’s market is less focused on expanding pricing multiples like the P/E ratio. As depicted in the chart, for both the Mag 7 and the remainder of the S&P 500, EPS growth is the main driver of overall growth in 2025. Additionally, it can be seen in the chart that the spread between returns for the Mag 7 and “the other 493,” has significant contracted, representing the “broadening out of returns” that we forecasted earlier this year.

So far this quarter, companies have performed very well in this regard. Nearly half of the companies that comprise the S&P 500 have reported earnings, and data from Zacks Investment Research indicates that 83.8% beat EPS estimates. Total earnings are up 10.7% from the same period last year, and revenues have grown 8%. Across nearly all sectors, upward revisions of corporate earnings have accelerated. The technology sector leads the pack, mainly fueled by AI capital expenditures.

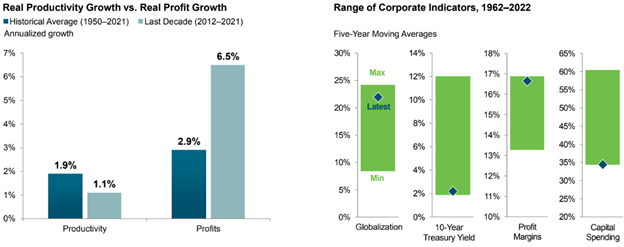

At the beginning of the year, we spoke extensively about productivity growth and the direct impact that it will have on earnings. At this point in the year, we are seeing more evidence that supports our view. Particularly, Fidelity pointed to the interest rate environment and state of the global supply chain as evidence to support our opinion. Over the last two decades, corporations were able to generate record-high earnings growth despite shrinking productivity due to a historically-low-interest rate environment and globalization of supply chains. With rates now at higher levels and global supply chains fully operational, companies have significantly raised capital expenditures, which may boost a positive outlook for productivity, as depicted in the chart. AI spending has totaled $375 billion so far this year and it is projected to reach $500 billion n 2026.

At Worcester Advisors, we continue to recommend investment in well diversified portfolios of high-quality companies with consistent earnings growth as the safest method of achieving capital growth.

Your team,

Dave, Joe, Sangam, Jake, & Anton

Request Your Complimentary Consultation

KEEP READING